Review Shengming Zhang 1 , MSc, BSc ; Chaohai Zhang 1 , BSc ; Jiaxin Zhang 1, 2 , PhD 1School of Automation and Intelligent Manufacturing, Southern University of Science and Technology, Shenzhen, Guangdong, China 2Guangdong Provincial Key Laboratory of Fully Actuated System Control Theory and Technology, School of Automation and Intelligent Manufacturing, Southern University of Science

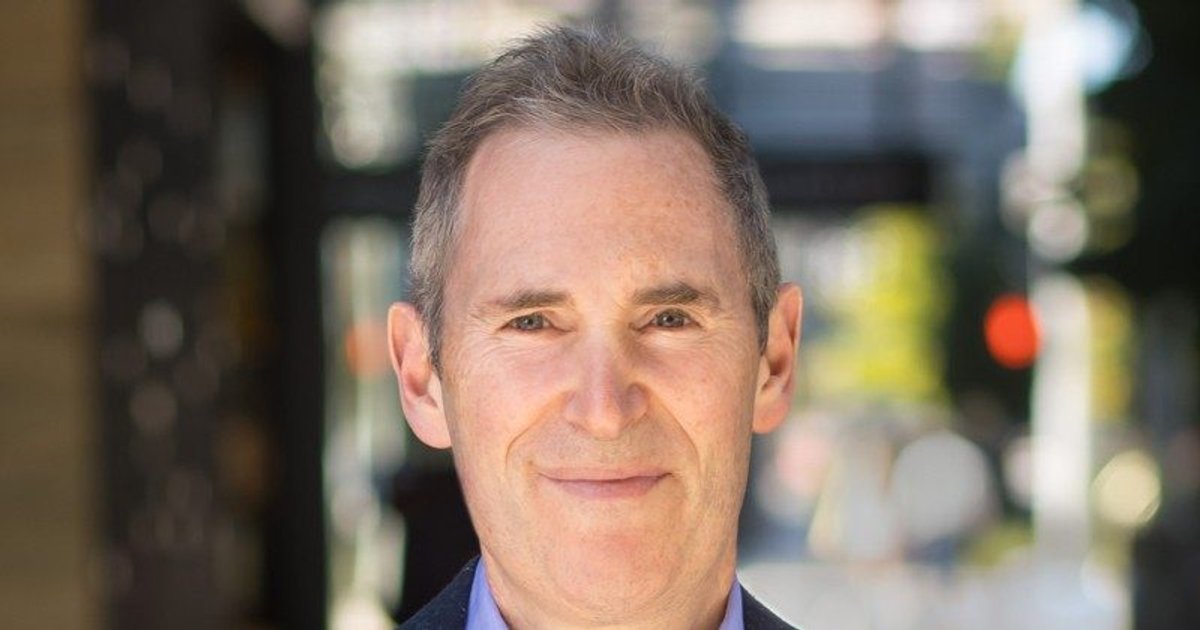

Amazon: Hatching a US$200bn AI Investment Plan

Amazon CEO Andy Jassy says the company will be “investing aggressively” in AI in the immediate future, joining a growing list of tech leaders accelerating their spending in the space.

On Amazon’s Q4 earnings call, he said the company expects to invest about US$200bn in capital expenditures across Amazon, with the bulk being directed to Amazon Web Services (AWS).

“Customers really want AWS core for AI workloads,” he said. “And we are monetising capacity as fast as we can install it.”

“We have deep experience understanding demand signals in the AWS business and then turning that capacity into a strong return on invested capital. We are confident this will be the case here as well.”

On the call, Andy outlined AI chips, robotics and low-orbit satellites as the company’s primary investment areas.

Pointing to the scale of the opportunity, he added: “I passionately believe that every customer experience that we know of today is going to be reinvented.

“With AI, there are going to be a whole bunch of customer experiences none of us ever imagined that are going to become the norms of how we all operate every day and what we use.”

2025 results and AWS momentum

Amazon’s net income increased to US$77.7bn, compared with US$59.2bn in 2024. Operating income was US$80bn in 2025, compared with US638bn in 2024.

Net sales rose 12% to US$716.9bn, with particular success in AWS segment sales, which increased 20% year-over-year to US$128.7bn.

Andy said: “AWS growing 24% (our fastest growth in 13 quarters), Advertising growing 22%, Stores growing briskly across North America and International, our chips business growing triple digit percentages year-over-year – this growth is happening because we’re continuing to innovate at a rapid rate, and identify and knock down customer problems.”

Amazon also highlighted new AWS agreements during the year with OpenAI, Visa, the NBA, BlackRock, Perplexity, Lyft, United Airlines, DoorDash, Salesforce, US Air Force, Adobe, Thomson Reuters, AT&T, S&P Global, London Stock Exchange, Accenture, Indeed and HSBC, among others.

Industry-wide acceleration in AI spend

Andy’s stance mirrors broader industry momentum. Alongside Google’s Sundar Pichai, who is increasing investment in AI infrastructure and AI-native cloud offerings, Meta CEO Mark Zuckerberg underscored the theme on Meta’s 28 January earnings call.

“We had a strong business performance in 2025. Our business also performed very well thanks to record-breaking holiday demand and AI-driven performance gains,” he said.

Unlike Amazon, the results helped to lift Meta’s share price by somewhere between 6–10% in extended trading following the announcement.

Meta also outlined a dramatic escalation in investment during 2026. The company expects capital expenditures to range between US$115bn and US$135bn – nearly double the US$72.2bn spent in 2025, with most earmarked for data centres, servers and networking equipment to train and deploy more sophisticated AI models.

“We are now seeing a major AI acceleration. I expect 2026 to be a year where this wave accelerates even further,” Mark continued.

“As we plan for the future, we will continue to invest very significantly in infrastructure to train leading models and deliver personal superintelligence to billions of people and businesses around the world.”