‘Every Azure region is now AI-first,’ said Microsoft CEO Satya Nadella Microsoft delivered profits up 24% year-over-year and revenue of $76.4 billion for the quarter, up 18% from the same time last year, driven on the strength of demand for cloud and AI infrastructure and services. Microsoft Cloud revenues for the quarter were stronger than expected

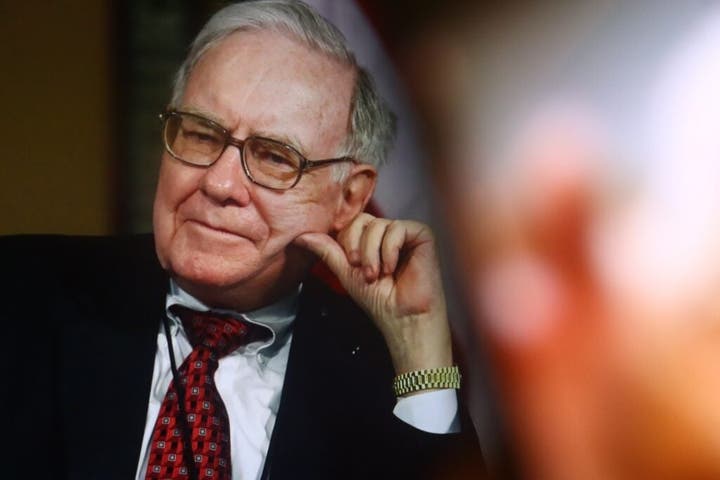

Warren Buffett Has 56% Of His $258 Billion Portfolio’s Value Exposed To AI – Yahoo Finance

3 min read

In This Article:

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

The ‘Oracle of Omaha’ — Warren Buffett is not invested in any pure-play artificial intelligence (AI) companies, but he holds these five stocks via Berkshire Hathaway Inc. (NYSE:BRK) (NYSE:BRK), which leverage AI in their businesses on scale.

Check out the BRK-B stock price here.

What Happened: While the companies that Buffett holds via Berkshire don’t directly make or create AI-related products or services, about 55.77% of the value of its total $258.701 billion portfolio is invested in these five firms, leveraging AI heavily on a day-to-day basis.

Out of the total 36 holdings as of the end of the first quarter, Berkshire holds about $114.423 billion worth of shares in Apple Inc. (NASDAQ:AAPL), American Express Co. (NYSE:AXP), Visa Inc. (NYSE:V), Mastercard Inc. (NYSE:MA), and Amazon.com Inc. (NASDAQ:AMZN).

Trending: 7,000+ investors have joined Timeplast’s mission to eliminate microplastics—now it’s your turn to invest in the future of sustainable plastic before time runs out.

|

Company |

Holdings (as of March 31) |

% In The Portfolio |

Value (as of March 31) |

|

Apple Inc. (NASDAQ:AAPL) |

300,000,000 |

26% |

$66.639 billion |

|

American Express Co. (NYSE:AXP) |

151,610,700 |

16% |

$40.79 billion |

|

Visa Inc. (NYSE:V) |

8,297,460 |

1.1% |

$2.907 billion |

|

Mastercard Inc. (NYSE:MA) |

3,986,648 |

0.8% |

$2.185 billion |

|

Amazon.com Inc. (NASDAQ:AMZN) |

10,000,000 |

0.7% |

$1.902 billion |

-

Not an AI stock in the traditional sense, but Apple heavily integrates AI into its products and services.

-

Features like Siri, on-device machine learning for Face ID, photo processing, and Apple Intelligence (AI-driven features in iOS) show deep AI investment.

-

Its focus on privacy-preserving AI and custom silicon (e.g., Neural Engine in A-series chips) positions it as a leader in consumer AI applications.

-

Also, not an AI stock, Amex uses AI for credit risk assessment, fraud detection, and personalized marketing.

-

Its data-driven approach leverages machine learning to enhance customer experiences, but its core business is financial services and payments, not AI development.

-

While primarily an e-commerce and cloud computing giant, Amazon is a major AI player through Amazon Web Services (AWS), which offers AI and machine learning tools like SageMaker, Bedrock, and Titan models.

-

AI powers Amazon’s recommendation algorithms, logistics optimization, and Alexa. Its cloud dominance makes it a backbone for many AI companies, so it’s closer to an AI stock than most.